This article will take a comprehensive look at boat values and pricing. The world of boat ownership is intricately connected to economic fluctuations, with boats being subject to the ebb and flow of various factors. As we delve into the nuances of the current economic climate, it becomes evident that boat values and prices are not immune to the influences of consumer behaviour, interest rates, supply chain issues, and global economic trends.

Consumer confidence and spending

Consumer confidence serves as a barometer for the boat market. In times of economic prosperity, increased discretionary spending often leads to heightened demand for luxury items like boats. However, as we enter 2024, consumer spending is on the decline, signalling potential challenges for the boat market. Forbes reports a shift in retail spending that may impact demand and, subsequently, boat values.

Interest rates and financing

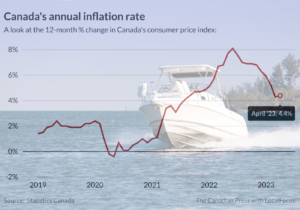

The interest rate landscape plays a crucial role in shaping boat purchases. Low interest rates incentivize financing, making boat acquisitions more attractive. Conversely, higher interest rates can dampen enthusiasm for financing, impacting both demand and value. The recent series of interest rate hikes by the Federal Reserve in Canada, totalling nine, adds another layer of complexity to the boat market.

In addition to financing, the federal government of Canada implemented a luxury tax on boats valued at over $250,000. This impacts the price of boats. For more information refer to: What brokers need to know to help boat owners navigate the new luxury boat tax.

Supply and demand dynamics

The delicate balance of supply and demand is a key factor in boat pricing. Economic downturns can prompt boat owners to sell, flooding the market with supply and potentially exerting downward pressure on prices. According to Courtney Chalmers, vice president of marketing for Boats Group and reported on BoatU.S., manufacturers have caught up to demand and inventory availability has begun to stabilize. Market experts speculate that used boat prices should start to come down as supply and demand return to a more conventional balance.

Fuel prices and operational costs

The cost of fuel directly influences potential buyers’ decision-making, impacting both demand and, consequently, values. Fluctuations in fuel prices can contribute to shifts in the boat market.

Global economic trends affecting boat values

International trade, geopolitical events, and economic trends create ripples in the boat market. Shifts in these areas may influence manufacturing and importing costs, ultimately affecting boat values.

Changing consumer behaviours

The last few years have seen drastic changes in consumer behaviours, including the rise of remote work and sharing economies. These behaviours can significantly impact how people enter the boat market, adding a layer of unpredictability on supply and demand.

Supply chain issues and recreational boat values

Supply chain interruptions, stemming from shipping container shortages, volatile fuel prices, and global events, continue to impact the recreational boat market. These disruptions are reshaping the landscape of boat values in several ways:

- Production delays: Limited availability and disruptions can lead to delays in new boat production, potentially driving up prices for existing inventory.

- Component shortages: Delays in key components impact production outputs, lower supply, and increase boat pricing.

- Used market surge: A lack of new inventory can drive buyers to the used market, increasing values for pre-owned vessels.

- Cost escalation: Supply chain issues may lead to higher material and production costs, affecting overall pricing.

- Longer wait times: Increased wait times due to supply chain disruptions may drive customers towards available inventory, affecting demand for existing boats.

Boat values and pricing outlook for 2024

In the short term, 2024 boat prices are unlikely to see significant decreases due to ongoing market dynamics. But as the economy unfolds into Q1 and beyond, there could be some headwinds.

According to Jeff Palmer, President of United Yacht sales, “The yacht market has been robust for some and difficult for others, depending upon what you’re in the market to buy.” He also indicated that yacht sales were down across the industry, the average day on the market is 10% higher and prices dropped by 16% from April 2022 to May 2023.

In the ever-changing seas of the boat market, economic factors and supply chain issues act as both wind and tide, shaping the values of these recreational vessels. Sellers and buyers alike should carefully consider market trends, comparable listings, and the condition of boats to navigate these waters successfully. Balancing competitive pricing with market conditions is key to thriving in the recreational boating market. As boats sail through the economic currents, their values remain tethered to the intricate dance of supply, demand, and global economic forces.

Captain Sam: Buying a Boat

United Yacht: It’s yacht selling season

MRAA: Marine industry insights

Safe Harbour Insurance: Why it is important to know the value of your boat.